Feel like you're always paying to much tax and want to SLASH YOUR INCOME TAX even FURTHER?

He earns a salary of $120k per annum.

And pays $34,432 in income tax every year.

Larry takes all his receipts and documen- tation to his everyday accountant. His everyday accountant inputs all the information into his tax return and based on what Larry has told him his everyday accountant manages to obtain a tax refund for him.

$1,200

And he's happy as Larry!

$1,200

And Bob is happy too!

NO PRIVATE

TAX REPORT

PRIVATE TAX REPORT

Bob also receives his very own personlised Private Tax Report. Which shows him exactly where he stands from a tax and financialperspective.

NO TAX

PLANNING

TAX PLANNING

Bob and his Tax Effective accountant sit down together with the Private Tax Report and discuss how to reduce his personal tax by up to 70%.

NO

TAX REDUCTION

STRATEGIES

TAX REDUCTION

STRATEGIES

TAX REDUCTION STRATEGIES

Bob implemented a tax reduction strategy that helped him reduce his taxable income by $30,20 per anum.

NO

ASSET BUILDING

STRATEGIES

ASSET BUILDING

STRATEGIES

ASSET BUILDING STRATEGIES

Bob implemented a $1.2 million investment portfolio which was funded by his tax savings.

NO

DEBT REDUCTION

STRATEGIES

DEBT REDUCTION STRATEGIES

Bob implemented a strategy to pay off his home loan in a fraction of the time. Saving him over $480,000 in interest payments.

NO

DEBT RECYCLING

DEBT RECYCLING

Bob implemented a strategy to take non-deductable debt and recycle it into deductable debt. Allowing him to reduce his taxable income by $8,600 per annum.

NO

ASSET PROTECTION

STRATEGIES

ASSET PROTECTION STRATEGIES

Bob implemented a structure that effectively protects his assets from lawsuits and secures his families future.

He earns a salary of $120k per annum.

And pays $34,432 in income tax every year.

Larry takes all his receipts and documen- tation to his everyday accountant. His everyday accountant inputs all the information into his tax return and based on what Larry has told him his everyday accountant manages to obtain a tax refund for him.

$1,200

And he's happy as Larry!

NO PRIVATE

TAX REPORT

NO TAX

PLANNING

NO

TAX REDUCTION

STRATEGIES

TAX REDUCTION

STRATEGIES

NO

ASSET BUILDING

STRATEGIES

ASSET BUILDING

STRATEGIES

NO

DEBT REDUCTION

STRATEGIES

NO

DEBT RECYCLING

NO

ASSET PROTECTION

STRATEGIES

$1,200

And Bob is happy too!

PRIVATE TAX REPORT

Bob also receives his very own personlised Private Tax Report. Which shows him exactly where he stands from a tax and financialperspective.

TAX PLANNING

Bob and his Tax Effective accountant sit down together with the Private Tax Report and discuss how to reduce his personal tax by up to 70%.

TAX REDUCTION STRATEGIES

Bob implemented a tax reduction strategy that helped him reduce his taxable income by $30,20 per anum.

ASSET BUILDING STRATEGIES

Bob implemented a $1.2 million investment portfolio which was funded by his tax savings.

DEBT REDUCTION STRATEGIES

Bob implemented a strategy to pay off his home loan in a fraction of the time. Saving him over $480,000 in interest payments.

DEBT RECYCLING

Bob implemented a strategy to take non-deductable debt and recycle it into deductable debt. Allowing him to reduce his taxable income by $8,600 per annum.

ASSET PROTECTION STRATEGIES

Bob implemented a structure that effectively protects his assets from lawsuits and secures his families future.

Larry still has a salary $120kper annum.

Larry pays$34,432 in income tax every

year and still receives a tax refund of only $1,200.

And he's happy as Larry (or so he thinks)!

Bob still has a salary of $120k per annum.

Bob however pays only $19,559 in income tax and receives a tax refund of $16,073.

That's a tax refund of 13x higher than Larry received.

Larry pays

$332,320

in income tax.

Bob pays only

$183,590

in income tax A 53% reduction in tax paid per annum.

He increased his wealth by $2 million and saved $480k in interest payments.

Larry receives

in tax refunds.

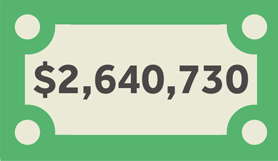

Bob receives

in tax refunds,

wealth creation and debt reduction strategies.